Although Lidl announced plans to slow its US expansion, it’s too close to call.

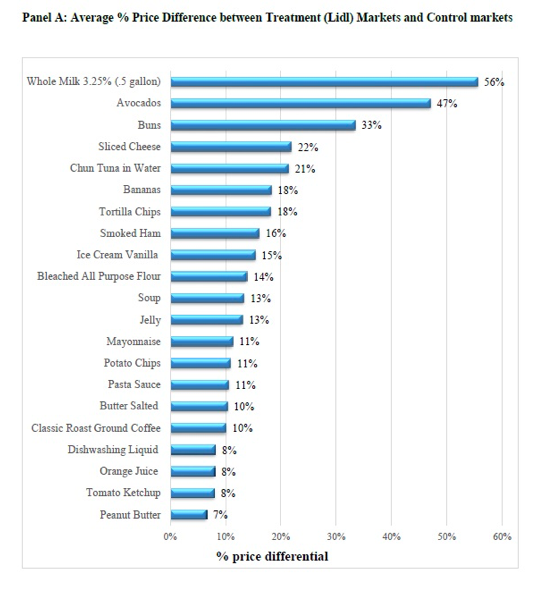

According to a study by the University of North Carolina’s Kenan-Flagler Business School, in areas where Lidl has opened stores, grocery prices are down by as much as 55%. On average, competing retailers near Lidl stores charge 9% less than in places where Lidl has no presence. As competitors quickly matched prices, Lidl hasn’t been as successful as expected and has decided to slow its expansion in the US.

On January 17th, Handelsblatt (a German business newspaper) stated that Lidl is facing difficulties in the United States. A company spokesman admitted that the expansion strategy “needs adjustment.” In the same article, Michael Rogosa from Retailnet Group stated that “Lidl’s management underestimated the challenge in the US. They failed to understand how complex and diverse the US market is.” The article has been largely spread by the American press—as Forbes noted, “Finally Lidl sees the need for a strategic plan for future expansion.”

Aggressive discount policy

The Kenan-Flagler study also revealed that Aldi customers save up to $14 on their total purchase in markets where Lidl is present compared to areas with no competing Lidl store. In contrast, customers only save $3 at Walmart, as the corporate giant more quickly matches local prices.

Source: CNBC

Lidl in the United States is making adjustments

Lidl’s competitors are probably most interested in the slowing expansion, which is connected to changes in store size. Originally twice as large as a German Lidl store, Lidl’s US locations have recently been advertising for smaller stores.

As I read the Handelsblatt article, I couldn’t stop comparing Lidl to Aldi US. When I first visited Lidl in Manassas, VA, I spent over 20 minutes hunting for the store. My GPS may not have worked perfectly, but the store is not visible from the main road. According to Forbes, Lidl is now looking “to put its smaller stores in town centers where a high population density is within a radius of two miles.”. The company is also seeking co-tenants. All of this strongly reminded me of visiting an Aldi store in Gaithersburg, MD.

You can watch here my video of Aldi’s new store concept!

A few final words about Lidl in the United States

I’m not representative of most Lidl customers. Like so many Germans living in the US, I crave good old German bread, Bretzel, beer (well, at least for my husband), and many other German specialties. So, it’s no wonder that I drive at least an hour to Manassas in order to buy lots of German food.

I found shopping at Lidl enjoyable—and not only for the bakery corner (watch the video to know more!). Every time I’ve prepared the halal lamb I purchased, it was succulent. Originally, I picked up their organic ground beef with some skepticism, but it also exceeded my expectations. I love their choice of international cheese (French, Italian, and Spanish) and appreciated navigating their bright, well-lit aisles.

However, my favorite part of shopping doesn’t exactly match American tastes. Furthermore, the stores are gorgeous but expensive to build. I guess the newer, smaller ones will have fewer windows and a more limited international assortment of products. With that said, I wonder how Lidl will differentiate from other retailers. Will they reduce their strategy to price aggression only?

It’s your turn now! What are your thoughts on Lidl’s chance of success in the United States?

Foto credit : Flickr by txmx2

It’s hard for me to say how Lidl will do. I’ve only been to Lidl in Germany. I’ve been to Aldi I America and both in Germany. I find the Aldis in America and Germany quite similar. I far prefer Lidl to Aldi and it’s our go to store. After Lidl, we’ll generally go to Rewe or Edeka. We generally only go to Aldi if there’s something in their flyer thzt catches our attention. Aldi not only generally has inferior produce and products, they te d to be dirtier and run down.

So, I think Lidl has a good chance if they can co pare in America as they do here.

I haven’t been to a US Lidl, bnut I liked the one I shopped in at the Essen train statio. The problem they have, as you discussed, is a misguided approach to store location. Because of their store design and other elements, they have the opportunity to make more mainstream hardline discounting, compared to Walmart and Aldi, which don’t have the kind of “upscale” reputations that make shopping at such stores a kind of slumming, not to mention the grim store designs these chains employ.

That being said, their competitors weren’t sitting idly by. And Aldi is even testing a bakery offering.

We disagreed about Aldi’s upgrades in an earlier posting, but I mostly shop at a store in a lower income area, but they just opened a store on the outskirts of Downtown Silver Spring and while pretty similar to the Aldi in the ‘hood design and layout wise, it’s more sedate, the lines aren’t crazy, etc. I can see it being popular.

And as you know, they continue to add higher grade products, and this is key, because in the past I’ve mostly thought that there store brand processed foods aren’t particularly good. But now they have good enough hummus, tortilla chips, equivalent to Triscuits, etc., which is a game changer.

At least in Minneapolis, Aldi is doing urban stores in mixed use developments, where they are on the ground floor, with apartments above.

Maybe Lidl’s problem is that they are entering the US market “too late,” that they should have done so back when there were more second and third tier grocery chains. Now those companies are mostly gone and the market is much more competitive. Still, mainline supermarket companies don’t have that much flexibility to lower prices forever. If Lidl could gut out the introductory period, they could make it.

Yes, I have noticed the changes at Aldi. Maybe it’ll be all for the best for the customers?