When my father turned 59, he lost his job as a car mechanic. I remember him being a shadow of himself for two weeks, staying at home all day, and watching the TV with empty eyes. My joyful, upbeat Dad was filled with sorrow until he found out that he could go on pre-retirement.

My father left school at the age of 14. He could have completed a higher education program like his sister did later, but he couldn’t wait to work and make his own money. After 45 years, he had already qualified for full retirement benefits when he lost his job. During the next five years, he kept on working occasionally under the table, but his greatest achievement was a community garden that he kept until his death in 2012.

My mother was four years younger than my father, and she worked for a few more years before retiring at 62. As soon as she began staying at home, she fell into depression, not knowing how to fill in her days. The difference between my parents couldn’t have been bigger than when they retired. My Dad found ways to stay active, while my Mom lost her sense of purpose. She died at only 69 in 2009.

Retirement in the US in comparison with Germany or France

I was born and grew up in France. After graduating from college, I moved to Germany, where I worked for 20 years before relocating to the States. While the organization and perception of retirement in both France and Germany are similar, I was surprised to see people far past 65 working in the States. According to the Bureau of Labor Statistics, 18.8% of Americans ages 65 and older were working in May 2016, either full- or part-time.

It’s not that all Germans or French people stop working once they retire. It’s just that it doesn’t happen so frequently. According to a survey by INSEE (the French counterpart to the BLS), 7% of French retirees ages 60 to 69 were working in 2012. In Germany, the rate of working retirees was 5.4% in 2015, and that rate had doubled within 10 years.

Right now, French people can retire at age 62 or two years earlier, under certain circumstances. In Germany, I could retire at age 67. Since my thoughts on the subject would fill more than a single article, I won’t go into the details of German or French retirement politics. But, it should help you to understand my surprise when I encountered elderly workers at Home Depot in the States.

Across the board, financial need delays retirement

Most people put off retirement because they need money. Even if they reduce their expenses, French, German, and American retirement benefits are rarely enough to enjoy a comfortable retirement:

According to a survey by the Transamerica Center for Retirement Studies, almost half of American retirees said that financial concerns were their main reason for working past age 65. In France, half of working retirees said that the retirement benefits do not give them enough for a living.

Other reasons why Americans aren’t retiring

Americans like their jobs, and with a low unemployment rate, US employers are interested in keeping their older workers around. “They might not be able to replace them,” stated Bloomberg in an article called “I’ll Never Retire” in May 2016. Also, older Americans are healthier and living longer. With this rising life expectancy, working longer doesn’t mean a shorter retirement.

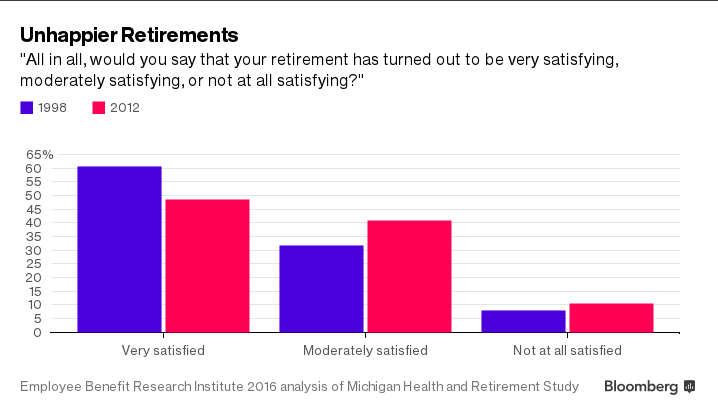

Another survey by the Employee Benefit Research Institute found that Americans may not enjoy their retirement as much as they thought.

Working retirees are an unstoppable trend in Germany and France

Every time I travel home to Germany, I can’t stop noticing how old people are. Yes, Germany is getting older, and the pension system is getting more and more unbalanced. The current benefits are paid from the premiums of individuals who have not yet retired, while the number of working people per retiree is predicted to halve in the next 40 years.

The famous German weekly periodical SPIEGEL summarized why more Germans may keep working after retirement:

For decades, Germans have been able to live out their golden years in comfort. For today’s younger generations, however, the retirement dream is turning into a nightmare. Increased life expectancies, an aging population, low birth rates, and vanished investment returns have many worrying about a future of poverty.

The situation is slightly different in France, which doesn’t suffer from low birth rates. However, the system resembles Germany’s with a redistribution from the actual payment to the actual retirees. A few weeks before Election Day, all candidates suggested changes to improve the financial situation of retirees. The former socialist/now leftist Mélenchon and right-wing populist Le Pen promised to lower the retirement age while raising pensions. The conservative Fillon would like to put the retirement age back to 65 but also increase benefits for the nation’s poorest, while others want to expand minimum pensions.

I’ll leave you to think of the financing of these proposals for yourself. Lowering the age of retirement while increasing payments sounds like a tax increase, which is very unpopular. In the end, the new president will probably make some cosmetic changes, and more and more French people will work after retirement.

There’s no American exception when it comes to retirement. Americans are just ahead of the curve compared to welfare states like France and Germany.

Photo credit: Fotolia by Olly

america failed–when you have an empire that was solely about hu$tling and huckstering–it was ontologically empty, spiritually dead/vacant. No real health care (except ‘discount’ cards), no real pensions/retirements (unless you die), no childcare, no universities, no long term care, no community, etc etc…UNLESS on takes on MASSIVE debt. It was a corporate owned state that loved war and imperialism.

What we got was: massive depression, pain, and loneliness. The result: off the hook opioids, obesity, TV, workholism, phone diddling, prescription drugs, suicides, massacre, etc…americans not being very bright simply cannot connect the dots.

A few years ago when I was home visiting, we went to The Cheesecake Factory and our waitress was in her 70s. She was great and was able to do her job well, but I couldn’t help but feel a little sad. I don’t know if she needed the money or if she was working just a few hours a week to stay active, but either way, we left her a big tip. I hope she was working because she wanted to, not because she had to.

Great post!

That’s exactly how I feel! Sometimes I’m also ashamed to ask for help to put something into my car. I wouldn’t let my Dad do that anymore for me, so why should an older man do that for me??